Editorial: Why Your Discovery Funnel Is Flattening and What Smart Small Businesses Should Do Instead

Most small-business growth models lean on a simple formula: build traffic → convert leads → scale channels. That worked when search and click-through were dominant. But that model is now under pressure. The system that got you to year-3 or year-5 is starting to misbehave, and it's not because you lack leads, but because youʼre playing yesterdayʼs game in tomorrowʼs context. Before inventing new channels, refactor how discovery and conversion connect in the AI era.

Here are three strategic shifts that do most of the heavy lifting in this phase of change.

1. Discovery is being rewired

More U.S. shoppers are bringing AI into the journey, with roughly one-third to two-fifths using it today and about half saying they plan to. This is a clear shift thatʼs pressuring the old “search → click → websiteˮ funnel. AI agents, answer-generators, and conversational interfaces are taking over discovery, meaning small businesses can no longer rely solely on organic rankings to drive leads. To stay visible, businesses should audit their top keywords to identify which are now conversational, optimize content to appear as AI-readable snippets or recommendations, and create lightweight assets like Q&As, fact sheets, or calculators that can be easily indexed and cited by AI systems.

In the AI-driven discovery era, visibility depends less on page rankings and more on structured, trustworthy signals. AI systems now favor content thatʼs machine-readable, credible, and frequently cited. For established small businesses, this means building agent-ready content, using schema markup to make your site easily parsed, publishing thought-leadership that earns external references, and securing consistent mentions in reputable trade or industry outlets. Each of these actions strengthens your brandʼs trust footprint, helping AI agents surface your business as a credible answer in a world beyond traditional SEO.

3. Diversify the paths to conversion, not just new channels

Many growth plans focus on adding more channels such as YouTube, Instagram, influencers etc. But the real shift is in how people buy, not just where. Customers increasingly rely on digital assistants that recommend, compare, and even route them directly to checkout, bypassing traditional search and website visits. To stay relevant, businesses must design frictionless buyer journeys that move from discovery to action seamlessly. This means mapping where AI assistants influence decisions, creating quick opt-ins or micro-tools that capture leads instantly, and aligning paid efforts within AI or chatbot ecosystems to mirror how modern buyers actually make purchasing decisions.

For 20-100-person teams, this means appointing a “Discovery + AIˮ lead, reviewing visibility in assistant ecosystems quarterly, creating at least one agent-ready asset each month, and training teams to operate in hybrid funnels where chatbots, tools, and human calls work together to capture and convert faster-moving leads.

Case Study: How Focus Financial Rewired Growth Around Unification and Organic Pull

Focus Financial Partners has been consolidating internally since 2023. In September 2025, new CSO Travis Danysh laid out how the firm is now treating organic growth as a first-order priority, alongside a measured return to external M&A. Focus combined many affiliated firms into five regional wealth hubs. Each hub now carries the Focus name, such as Focus Partners Wealth, so clients and advisors experience one unified firm rather than a collection of separate boutiques. The aim is clearer branding, shared standards, and growth playbooks that travel across offices.

Rather than mandate participation, Focus is earning buy-in. More than 25 of 85 fiduciary firms have opted into the hubs, supported by common equity and incentives that align advisors around a shared client experience and career paths. With Chief Growth Officer Zinovy Iosovich leading execution, the org is putting more time and resources into the referral + digital motion while keeping M&A for symbiotic capability fits.

Scale is now a growth engine, not just an org chart. Focus cites $400B+ in client assets and 6,300+ team members across the network, capabilities Danysh wants to operationalize so one firmʼs win becomes everyoneʼs playbook. Recent deals (e.g., Churchill Management) are framed as two-way fits rather than succession catch-alls, reinforcing the “platformˮ thesis over a pure roll-up.

Hereʼs what made this tactically effective

Unify first: Five hubs, shared brand architecture, and common

Equity/incentives created conditions for portable growth playbooks.

Earned adoption: 25+ / 85 firms joined voluntarily.

Organic by design: A named Chief Growth Officer and explicit focus on referrals + digital marketing turn organic from a slogan into a resourced motion.

Selective M&A: Symbiotic need filter (e.g., Churchill Management) prioritizes capability fit, not just AUM aggregation.

Public markers in the past two months show Focus formalizing its strategy (CSO appointment), consolidating into hubs, and redirecting attention to organic growth with centralized leadership, all while resuming targeted external M&A, signaling a shift from decentralized roll-up to platform-led, playbook-driven expansion.

Play of the Week: Make Your Brand Machine- Readable

AI is the new front desk for buyers, and if your communication is consistent and your proof pages are easy to link, large models learn to pick you first. Your goal is to be the brand they can recognize and recommend without confusion. Here are a few things you can do to gain more visibility as search traffic moves from Google to ChatGPT.

Name things clearly - Use simple product families and avoid look-alike codes.

Say it the same way everywhere - Reuse the same short descriptors on your site, deck, and docs.

Publish the proof people link to - Ship evergreen pages (benchmarks, calculators, pricing) that trusted sites will reference.

Make pages scannable - Show specs, side-by-side comparisons, and a plain “who itʼs for.ˮ

Think of Dysonʼs tidy cordless lineup versus messy, overlapping series elsewhere. The simpler the system, the easier it is for models and buyers to match intent to your product.

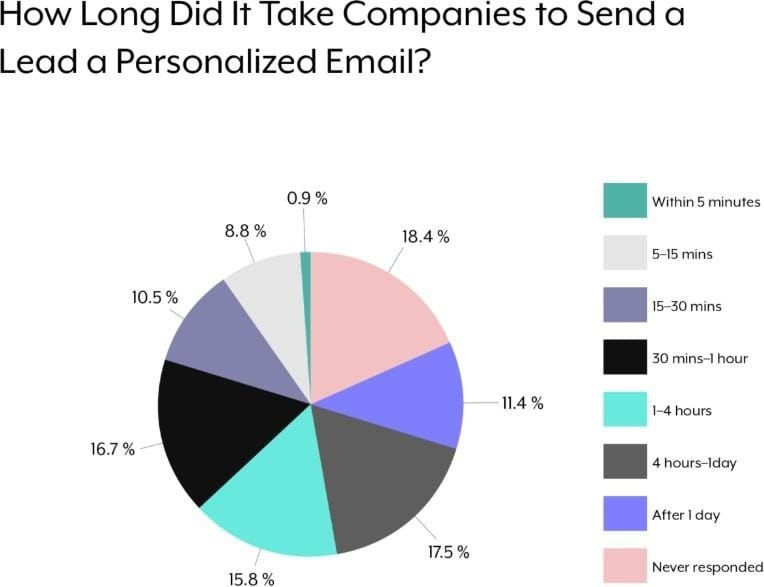

Metric Benchmark

Sample Size: 114 B2B Businesses

Closing Note

Unify the story. Make it easy for both people and machines to recognize you, and shorten the path from first touch to first draft. Focus Financialʼs shift shows that when brand, incentives, and playbooks line up, organic growth becomes a system rather than a slogan. Every asset reinforces the same promise, every handoff carries the same next step, and every office learns from the last win.

This week, choose one artifact to standardize, one referral loop to instrument, and one agent-readable page to publish.

Sponsor Spotlight: Newsletter

Spacebar Studios are offering to set up a brand-new newsletter for free for subscribers of this newsletter.

If you run a company doing $1M–$50M in revenue and want a growth channel that compounds every time you hit “send,” I’d book a call by clicking on the image below ASAP while slots are still open.

📣 Forward or Reply

If you liked this edition of Growth Curve, forward it to a founder who needs to stop renting audience — and start owning it.